Russia’s Agricultural Machinery Builders are facing huge issues

The case of Rostselmash

With Western sanctions introduced, after Russia moved into Ukraine, many challenges came up for Russian manufacturers such as Rostselmash (which exports roughly 8% of its production)

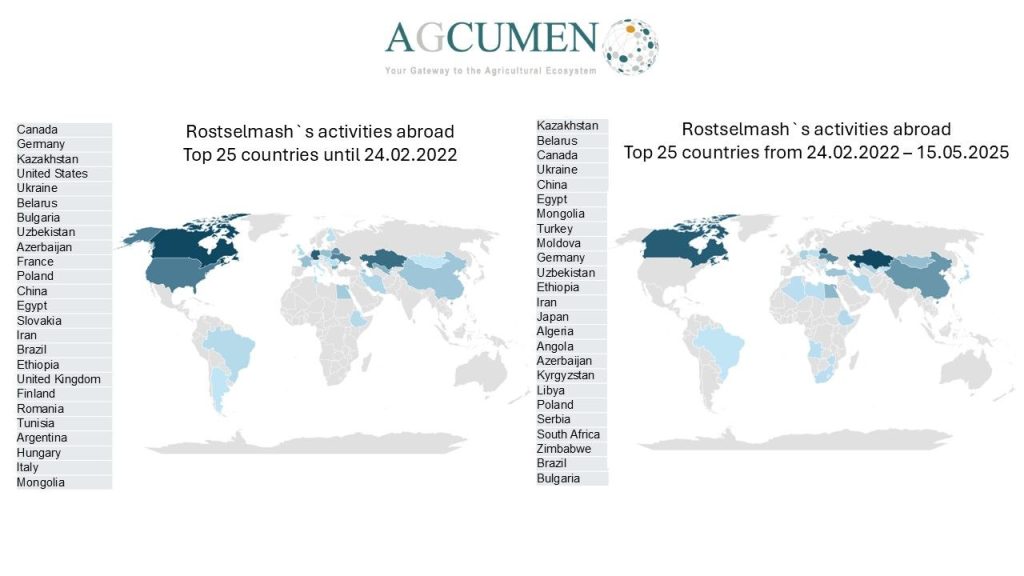

1) Rostselmash e.g. had to diversify its international markets (see graphic below), and its top 25 countries (on the left in descending order) changed significantly when it comes to activities abroad. The world maps show how it retracted from Western countries and focused more on the Commonwealth of Independent States, China, Africa, Asia, and selected Eastern European countries. It sold its business in Canada (Buhler Industries) to a Turkish company, and was still active in parts of Ukraine which were occupied by Russia. The new orientation increased liquidity risks considerably.

2) With Trump’s latest politics globally, and his proximity to Russian President Putin, Konstantin Babkin, the co-owner of Russian manufacturer Rostselmash argues that the return of Western brands of agricultural machinery to Russia could destroy Russian mechanical engineering“, mainly due to the production conditions in the country.

3) Sales of Russian agricultural machinery on the domestic market decreased 32.9% to RUB 38.3 bn (EUR 430 mn) in the first quarter of 2025 compared to the same period in 2024. The high key interest rate of the Central Bank, low profitability of agricultural business, insufficient funding of government support measures for farmers and machine builders, as well as the growth in the cost of production of equipment and agricultural products are the reasons for the decline.

4) Babkin also reports that the inventories at the ten largest Russian agricultural machinery manufacturers as of 12 March, 2025 increased by 72% compared to 2024, from RUB 36 bn (EUR 380.0 mn) to RUB 62 bn (EUR 654.5 mn). Machines worth RUB 60 bn (EUR 634.0 mn) are now in warehouses. This situation is worse for Rostselmash since 40% of its annual production is now in warehouses.

5) Russian manufacturers source many components now from manufacturers in China, Turkey and India (via a back door). Previously, Russian companies would import the components from Europe in two weeks, but now Russia imports them in two or even three months. Since interest rates are so high in Russia, transport has even become more expensive, which results in an increase in the cost of machines manufactured in Russia which have become roughly 15% more expensive.

Apart from an increasing dependency on Chinese machinery competing with locally produced Russian machinery, the situation has certainly increased pressure on Rostselmash and Russian manufacturers in general.

We therefore believe that the mounting pressure will soon be reflected in political decisions by the government as Economic realities are catching up with political moves.

UPDATE: Russian manufacturer Rostselmash announced that it is making adjustments to the work schedule “to optimise production costs in the context of a sharp deterioration in the situation on the agricultural machinery market”. The single annual vacation of workers in 2025 will be moved from August/September to June 2025. According to Rostselmash, deliveries by all Russian manufacturers in January-April 2025 period decreased compared to the same period in 2021 by 76 % for grain harvesters, by 49 % for forage harvesters, and by 48 % for articulated tractors.

Due to the decline in demand for the third year in row, Russian manufacturer have now to adjust their plans downwards, seen here. What Rostselmash does not mention in its press release is that the furlough in June 2025 will place all 15,000 of its employees on leave. The company reported a significant year-on-year drop in net income in 2024, down to RUB 6.9 bn (EUR 76.0 mn), with total revenue falling nearly RUB 20 bn (EUR 220.3 mn) to RUB 78.3 bn (EUR 862.5 mn) here.