Global Corporate M&A and Corporate Finance Activities in the Agricultural Machinery Ecosystem(April 2015 – October 2025)

In the past 10+ years, we have picked up over 3,600 Corporate Finance, and 4,100 Corporate M&A related developments across 110+ countries in the Agricultural Machinery related Ecosystem.

This included Corporate Finance related investments (minority shares) into startups, manufacturers, suppliers, intermediaries (importers, distributors, dealers), and other relevant organisations in the value chain.

Corporate M&A related activities (majority shares) reflect the consolidation in the industry, and also affected the entire value chain.

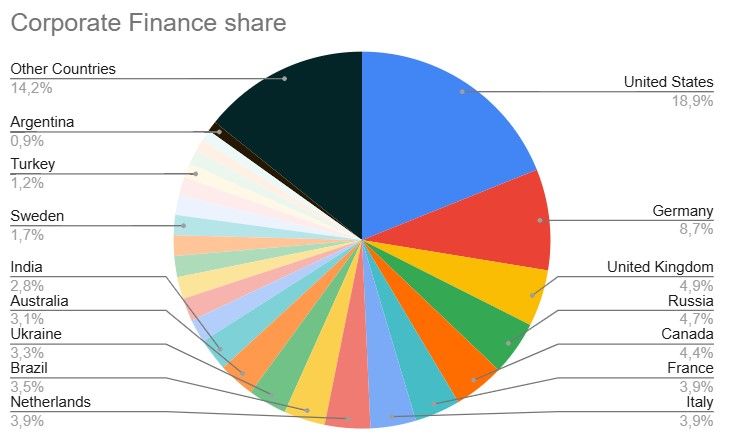

The United States represented most Corporate Finance (18.91%), and M&A activities (15.48%), followed by Germany according to our Ecosystem Intelligence

When it comes to Corporate M&A activities, the main organisations involved (and their respective dealer networks) were, in descending order, John Deere, CNH, AGCO Corporation, CLAAS, Kubota Corporation, and Mahindra Group

When it comes to Corporate Finance activities, the main organisations involved (and their respective dealer networks) were again, in a different descending order, CNH, John Deere, Kubota Corporation, Claas, AGCO Corporation, and again Mahindra Group

Many of these companies initially buy a minority share e.g. in a startup before taking the company over, which is also very evident in John Deere`s, and CNH`s approach.